Gain clarity with our user-friendly dashboard, projecting future outcomes for each deposit.

Daily of 0.42% returns through disciplined FNO, NSE, and BSE equity management.

Effortlessly monitor daily deposit values and future forecasts with intuitive tools.

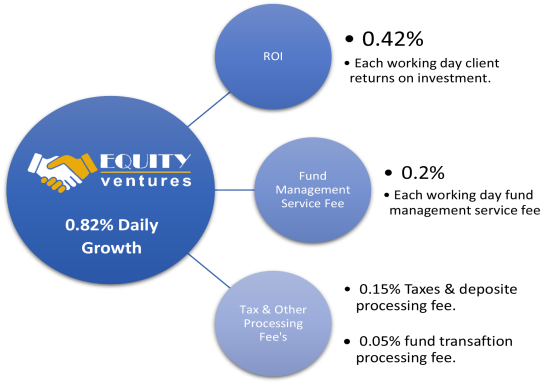

Equity Ventures, a subsidiary of ALL IN ZONE PRIVATE LIMITED, is dedicated to achieving a daily average return of 0.82% by strategically managing NSE and BSE equity stocks. We utilize advanced stock monetization algorithms powered by artificial intelligence to identify and capitalize on market opportunities. Our disciplined investment approach combines technical analysis, fundamental research, and proactive risk management to consistently deliver superior returns.

By staying adaptive to market dynamics and employing rigorous performance tracking, we aim to optimize investment outcomes and enhance wealth accumulation for our clients. At Equity Ventures, our commitment to excellence drives us to provide exceptional investment services and achieve outstanding results for our clients.

Optimized Returns through Strategic Equity Management

Experience consistent growth with our disciplined approach to managing Futures and Options (FNO), NSE, and BSE equity stocks. By leveraging advanced stock monetization algorithms and rigorous risk management strategies, we aim to deliver a daily average return of 0.82% to maximize your investment potential.

Fee Structure & Total Investment Revenue: Our transparent fee structure ensures value for your investments:

0.42% returns directly to clients

The minimum investment amount with Equity Ventures starts from 5,000 INR.

Equity Ventures offers a daily return rate of 0.42%, which is transferred directly to your bank account via NEFT. Additionally, there is a monthly return of 8.4% based on 20 working days.

Investors can choose between investment periods of 6 months or 12 months, providing flexibility based on individual financial goals.

Equity Ventures strategically manages investments in Futures and Options (FNO), as well as NSE and BSE equity stocks, focusing on liquidity and growth potential.

Equity Ventures employs advanced AI-driven algorithms for stock selection and risk management. This includes rigorous analysis and proactive strategies to mitigate investment risks.

The fee structure includes: 0.42% returned directly to clients 0.2% as a working fee 0.15% for taxes and investment processing 0.05% allocated to fund credit, ensuring transparent and efficient investment management.

Equity Ventures provides options for capital withdrawal or reinvestment at the end of the chosen investment period, either 6 months or 12 months.

Equity Ventures prioritizes transparency, providing detailed performance tracking and regular updates on investment strategies and outcomes.

Investors have access to a user-friendly dashboard that offers real-time updates on deposit values, daily earnings, and forecasts, facilitating informed decision-making.

Yes, Equity Ventures offers dedicated customer support to address inquiries and provide assistance throughout the investment journey.

Revenue generation occurs on all NSE India Equity working days, specifically from Monday to Friday.

Saturdays, Sundays, and Indian National public holidays are designated as non-working days. No revenue generation or investment activities take place on these days.

Investment returns are calculated based on the number of working days in a month, excluding weekends and public holidays. This ensures that returns are aligned with active trading days on the NSE.

Deposits and withdrawals are processed only on working days (Monday to Friday). Transactions requested on non-working days will be processed on the next available working day.

If a public holiday coincides with a regular working day, it is also considered a non-working day for investment purposes. Returns and transactions will resume on the next working day following the holiday.

You can register your account on Equity Ventures 24x7 by visiting our website and following the registration process. Enter your credentials securely to create your account.

Yes, you can log in to your Equity Ventures account 24x7 using your username and password. Ensure you keep your login credentials confidential and do not share them with third-party websites, applications, or individuals.

If you forget your password, you can use the "Forgot Password" feature on our login page to reset it securely. Follow the instructions provided to regain access to your account.

To maintain the security of your account, do not disclose your username, password, or any other confidential information to unauthorized parties. Equity Ventures will never ask for your password via email or phone.

If you face any difficulties with logging in or accessing your account, you can create a support ticket on the Equity Ventures platform. Our technical support team will assist you promptly to resolve any issues.

You can update your account information and preferences directly through your account settings on the Equity Ventures platform. Ensure to keep your information current for smooth account management.

Yes, Equity Ventures is committed to protecting your personal information. We adhere to strict security measures and protocols to safeguard your data against unauthorized access or disclosure.

Yes, Equity Ventures prioritizes security and transparency in all financial transactions and investment activities. Our platform uses encryption and secure protocols to ensure safe transactions and data protection.

The maximum investment per client at Equity Ventures is 1 lakh INR under their PAN ID.

COPYRIGHT © 2024 ALL RIGHT RESERVED